In 2018 I co-authored an article with Pierre Bouvard, Chief Insights Officer for Cumulus and Westwood One. We wanted to illustrate the robust spending power and household wealth of 50+ consumers who are largely ignored by advertisers, yet drive significant time spent listening to AM/FM radio.

AM/FM Radio Works for Boomers

Americans live longer lives now than they ever have. Today’s 50-year-old believes they will experience “life 2.0” with another 30-50 years ahead of them. That means 30-50 years of spending…and a lot of it.

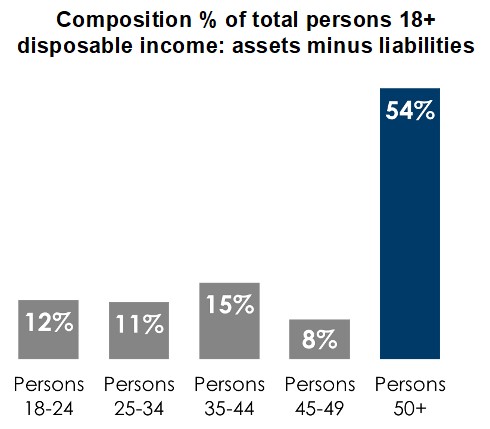

According to Oxford Economics, Americans over 50 account for $7.6 trillion in spending and control more than 80% of household wealth. Acxiom reports Boomers 50+ represent 54% of all disposable income.

Advertisers in fields like health, devices, travel, financials – take note. According to Robert Passikoff, President of Brand Keys Inc., “While the Millennials are sharing stuff, Boomers are buying stuff.”

How can this huge spending potential be influenced? With AM/FM radio.

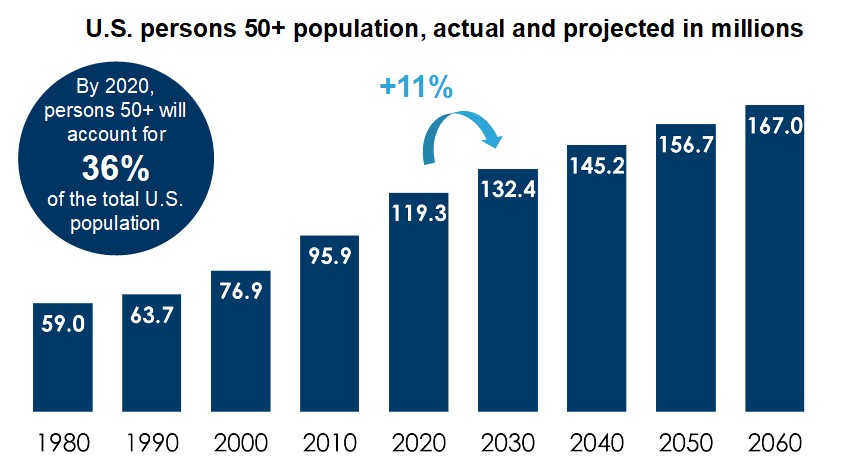

Huge audience: The persons 50+ population is forecast to increase +11% from 2020 to 2030

Source: U.S. Census Bureau, Population Estimates for 1980, 1990, 2000, 2010; U.S. Census Bureau, Population Division: Washington, DC., Projected Age Groups and Sex Composition of the Population: Main projections Series for the United States, 2017-2060

Boomers 50+ account for over half of all disposable income

“The spending power of those over age 50 is immense and will continue to grow in future years, presenting an incredible opportunity for marketers. Brand advertisers who ignore this audience, which totals over one-third of the U.S. population … do so at their own peril.“

Marianne Vita, Vice President

Strategic Insights / Video Advertising Bureau

Source: Scarborough USA+ (Current 6 months only) 2018 Release 2, Acxiom NetWorth Gold (HHLD)

The new car buyer is getting older: Persons 55+ is the #1 new car buying demo

Age profile among new car buyers

| 2009 | 2018 | |

|---|---|---|

| Median age | 49.6 | 52.0 |

| P18-34 | 22% | 24% |

| P35-54 | 38% | 31% |

| P55+ | 40% | 45% |

How to read: In 2018, 45% of all new vehicles were purchased by persons 55+.

Source: GfK MRI, Fall trend 2009-2018, Base: Persons 18+ Automobiles and other vehicles – New/used: Most recent purchase/lease (currently owned/leased): New

People 40+ are eager to try new things

“Most people in business are driven by shareholder value. Where can I make the most money? Perhaps the most untapped opportunity is hiding in plain sight. Back in my grandparents’ and parents’ time, when modern media was emerging on the scene people were pretty set in their ways. You weren’t changing your toothpaste brand when you were 50 or buying a new kind of hair product at 70. That is called brand loyalty and people were determining what product references were from the age of about 15 to 25.

There are a lot of products I am buying today that didn’t exist before. There was no software when I was 20. And, I have a lot more money and freedom now than I had before to do whatever I want. People who are 40, 50 or 70 are no longer brand loyal. They are reinventing themselves and very eager to try new things.”

Dr. Ken DychtwaldFounder & CEO / Age Wave

Source: MediaVillage, Where’s the Money? An Exclusive Interview with Age Wave’s Ken Dychtwald, Charlene Weisler

“Youth culture tethering” is destructive to advertising

“As wealth and economic power have been hugely concentrated in the hands of mature people, youth culture rarely interests or engages the people who have and spend most of the money.

One of the pernicious side-effects of this is our inability and, in fact, our blind refusal to speak to the people who have and spend most of the money in our economy.

There are two reasons advertising agencies default to youth imagery. First, the people in agencies are overwhelmingly young and don’t have the cultural vocabulary to speak comfortably to mature people … Second, binding to youth culture is such an easy and attractive way to seem relevant.”

Bob Hoffman

The Ad Contrarian

Source: Prisoners of Pop Culture, the Ad Contrarian, Bob Hoffman, July 21, 2019

“Don’t obsess over Millennials. There’s little empirical evidence they hold different attitudes. And at less than 10% of Western populations, and with a lower proportion of disposable income, you’d be right to question the extent of their presence on briefs.

Don’t underestimate the potential of the ‘Grey Market’. Older people outnumber Millennials, have more cash, and more time to spend it. The bigger the price tag, the more important they are.”

from: How Not to Plan: 66 Ways to Screw it Up

Sarah Carter

Global Planning Partner / Adam&eveDDB

Les Binet

Head of Effectiveness / Adam&eveDDB

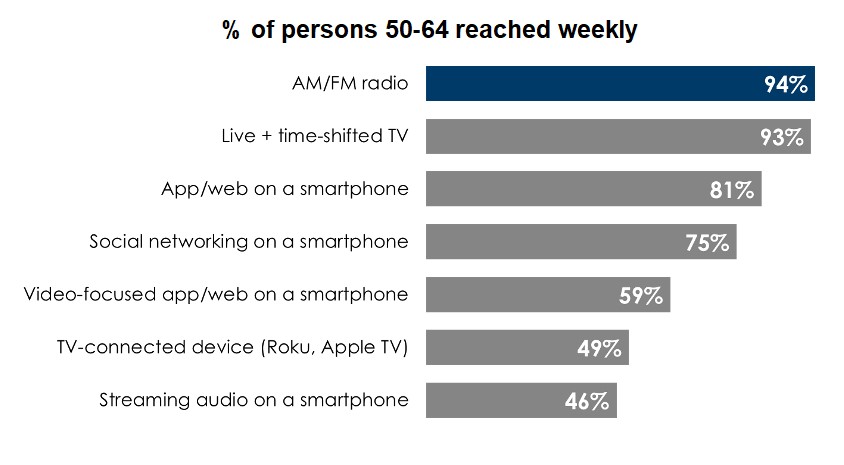

Among persons 50-64, AM/FM radio and TV leads in weekly reach

Source: Nielsen Total Audience Report Q1 2019

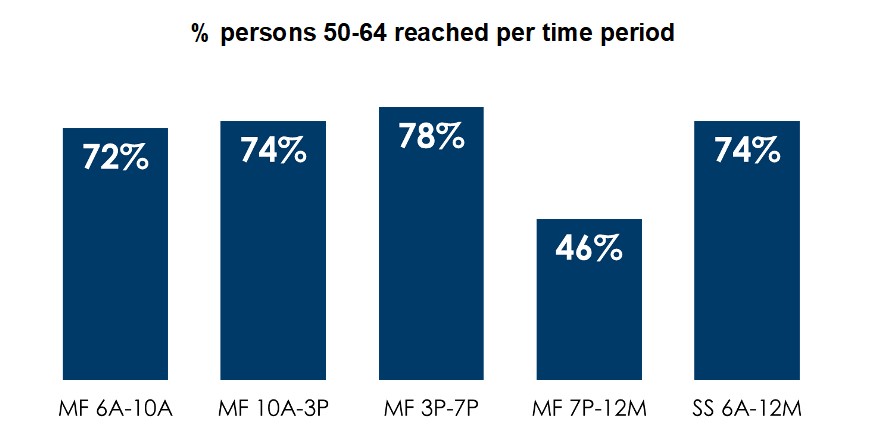

AM/FM radio reaches persons 50-64 throughout the day

Source: Nielsen Audio Fall Nationwide 2018, Persons Using Radio, Weekly Cume rating, Persons 50-64

Persons 55-64 spend more time with AM/FM radio daily than Millennials

WEEKLY TIME SPENT

Persons 50-64 spend

14 hours and 35 minutes

per week with AM/FM radio

DAILY TIME SPENT

Persons 50-64 spend

2 hours and 5 minutes

per day with AM/FM radio

Source: Nielsen Total Audience Report Q1 2019

A variety of AM/FM radio formats resonate with persons 50-64

Source: Fall 2018 Nielsen Audio Nationwide, Persons 50-64, Mon-Sun 6a-12m, Weekly cume

Key Takeaways

- The Boomer population is growing. In 2020, persons 50+ will account for 36% of the total U.S. population.

- Persons 50+ are working for longer periods of time and have disposable income. Boomers 55+ account for 41% of total aggregate expenditures, a total of $3.2 trillion.

- AM/FM radio is one of the top ways to reach persons 50-64, outreaching TV, apps and social networking on a smartphone and TV-connected devices.

- AM/FM radio has massive reach throughout the day among persons 50-64.

- AM/FM radio dominates audio time spent with a 61% share among persons 55-64.

- Persons 50-64 spend significant time with AM/FM radio. On average, they spend 2 hours and 5 minutes with AM/FM radio daily.

- A variety of AM/FM radio formats resonate with persons 50-64.

Classic Rock: The AM/FM radio format of the Boomer “formative years”

Boomers listened to Classic Rock during their formative years

The music we learn to love in adolescence stays with us to the grave. We may discover genres that came before or after, but none of it makes the emotional connection we form in that most impressionable time of life – our formative years.

During our formative years, we’re learning to drive, graduating high school, starting college, and developing our tastes.

The core Classic Rock audience today isn’t in the coveted persons 25-54 demographic. It’s the 45-64 audience who listened to Classic Rock during these pivotal moments as they grew up.

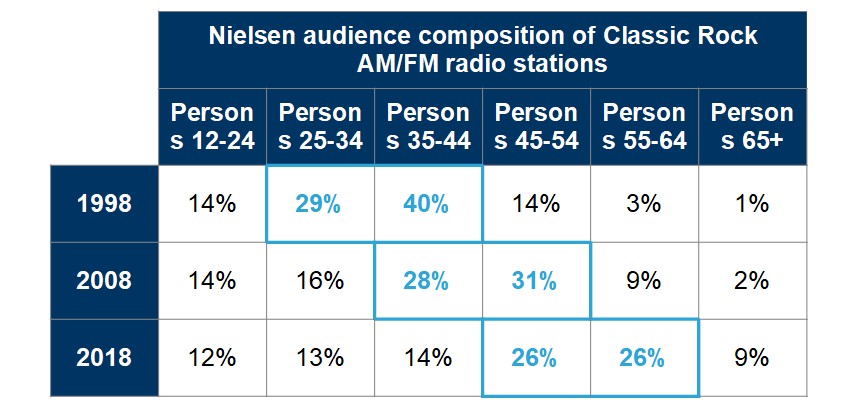

The Classic Rock AM/FM radio audience ages with the music

How to read: In 1998, 18-44s represented 83% of the Classic Rock audience. In 2018, 39% are18-44.

In 1998, those over the age of 45 were18% of the Classic Rock radio audience. In 2018, 61% is 45+.

Source: Nielsen Audio Nationwide, MS 6a-12m, Base: Persons 12+, AQH composition of AOR/Classic Rock format by demo using stations and surveys representative of time period.

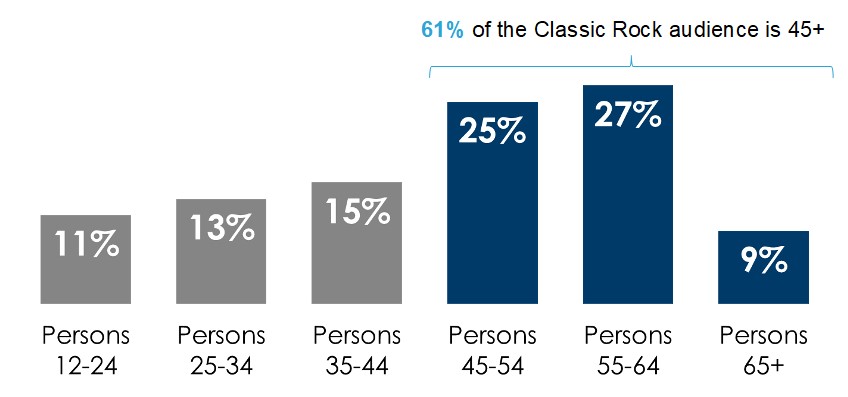

Why 35-64s are the best demo target: Boomers make up the Classic Rock audience

Classic Rock age composition across all U.S. Nielsen markets

Source: Nielsen Audio Nationwide, Fall 18, MS 6a-12m, Base: Persons 12+, AQH composition of AOR/Classic Rock format by demo using stations and surveys representative of time period

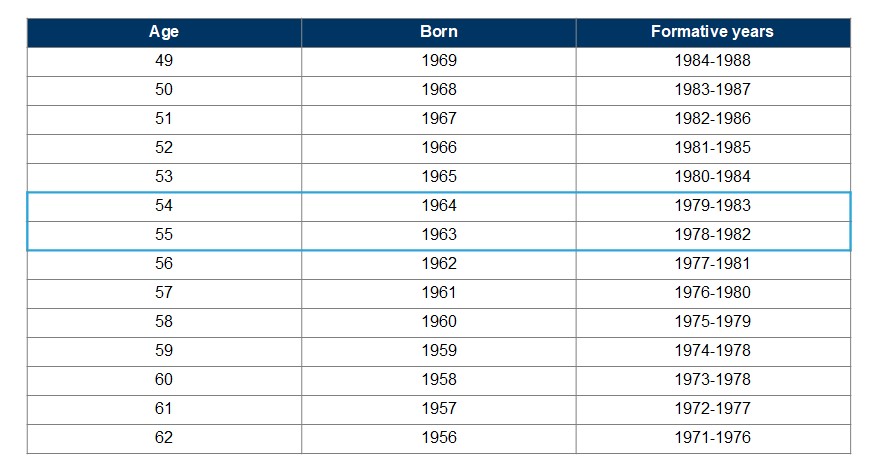

Classic Rock stations suffer from “demo cliff”

“Demo cliff” indicates edges of Nielsen’s demographic borders.

With such a strong focus on 25-54 year olds, a mere 12-24 months over the age of 54 causes real problems for Gold-based radio stations.

While differences in consumer behavior from 54 to 55 is minuscule, it’s a game changer in radio’s antiquated 25-54 transactional buying guidelines.

Source: Nielsen Audio Nationwide, Fall 18, MS 6a-12m, Base: Persons 12+, AQH composition of AOR/Classic Rock format by demo using stations and surveys representative of time period

“Radio formats like Classic Rock can gain from the aging of the U.S. population only if they understand and price to the power of this audience. Being held hostage to age limited demos will force those formats to drive younger audiences into their format, disenfranchising the 55-72 audience”